Building Your Nest Egg in 5 Steps

Do you have big dreams for your future or retirement? Do they involve living off of a nest egg?

If the answer is yes, you’re not alone. Millions of Americans plan their retirement around their nest egg, the savings upon which you retire and live off of.

When it comes to saving for retirement, the key is to start early. This is because the most common way of growing your nest egg is through investments. Investments made at an early age benefit more from compound interest than investments made at an age closer to retirement.

Many people find it overwhelming to start building a nest egg, given that it’s challenging to predict how much money you’ll need in retirement. But when it comes to investing, it’s time and not contribution size that matters most.

With that in mind, here are 5 steps to start building your nest egg.

1. Budget

Having a budget and sticking to it is the first and most important step for paying off debt, building wealth and adding to your nest egg. Your budget should account for your monthly take home pay, bills and expenses.

Once you have a budget, you should include building an emergency fund up if you don’t already have one. Open a high interest savings account and contribute monthly to it. With regular payments and compounding interest, you may be surprised how quickly the money adds up! Plan for monthly contributions to your emergency savings until you get it to a comfortable level (3-6 months of expenses is considered the sweet spot)

If you don’t have a budget, there’s more online tools available for budgeting and money management now than ever. With so many options, there’s a perfect tool for everyone.

Building and sticking to a budget is a skill that serves you at all stages of your life, retirement included.

2. Prioritize paying off debt

It’s hard to save when your debt is larger than your income! If you’re burdened by student loan debt or credit card debt, paying it off as quickly as possible is an effective way to lower your monthly expenses and contribute more money to your savings account each month. One way to increase the rate at which you pay off your debt is by applying the snowball method.

Popularized by money guru Dave Ramesy, the snowball method is a debt reduction strategy where you pay off your loans in order of smallest to largest. While making the minimum payments on each loan, you focus your money on the smallest loan. Once paid, you roll the money you were contributing to said loan into the next smallest loan payments. You can see how quickly your debt payments would escalate as each loan is paid off. This not only helps you pay off debt, it also saves you thousands in interest that would have otherwise accumulated.

3. Start a retirement account

There are two types of retirement accounts; employer-sponsored and individual accounts. Employer-sponsored accounts like 401ks and comparable plans can take contributions directly out of your paycheck, and often come with the added bonus of having employer-matched contributions. If your employer offers a retirement account and contribution matches, you’re leaving thousands of dollars on the table by not taking them up on it! Even if you only make the minimum contributions to your 401k, the further away from retirement you make them, the more time they’ll have to benefit from compound interest.

If you’re self-employed or your employer doesn’t offer retirement, you can still start saving with a Roth or Tradition IRA. Even small amounts added now turn into massive savings when left to compound interest over decades.

4. Invest wisely

Once you’re debt free and able to save comfortably, it’s time to consider your options for investments. Having a 401k is a great start to investing to grow your nest egg, but you have options beyond that as well. Consider seeking financial advice on the best way to grow your portfolio based on longevity and risk tolerance. You even have free options with services like SmartVestor.

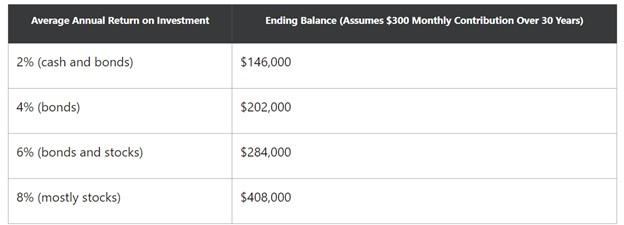

Here’s an example of a nest egg that puts away $300 a month for 30 years with 4 different investment strategies.

Example and calculations by the Motly Fool

5. Be consistent

When it comes to building a nest egg for retirement, it’s a marathon not a sprint. Start early because even small contributions add up with interest over the course of years or decade.

By creating and sticking to a budget at all stages of your life that includes retirement contributions and investments, you’ll be able to build your nest egg for the retirement of your dreams without sacrificing your quality of life today.

More to Read:

Previous Posts: