Detecting & Preventing Accounts Payable Fraud – Explained

Businesses run on finances that accumulate to a large number of transactions, and there comes the accounting department's responsibility to organize, reconcile, and manage complete records of each transaction. Narrowing down the duties, vendor and supplier payments are handled by the accounts payable department, which usually remains vulnerable to the risk of theft, to be precise – accounts payable fraud.

Since this type of fraud can be committed by anyone, for instance, external vendors or in-house employees, it is usually challenging to hold someone responsible, which can also be an outside party seeking access to the company's payment systems.

The Impact of AP Fraud

Each year, fraud causes a typical organization to lose 5% of its revenue – a median loss of $125,000 – Association of Certified Fraud Examiners (ACFE) - Source

On average, fraud can take around 14 months to be detected, accounting for an average loss of $8,300 per month.

The impact of fraud can be small or big. Still, a loss is a loss that must be prevented, and this is why many businesses outsource accounts payable services to a trusted and reliable AP service provider firm. Accounts payable fraud can be committed via a wide variety of schemes and tricks; getting further, let's discuss some of its broad types.

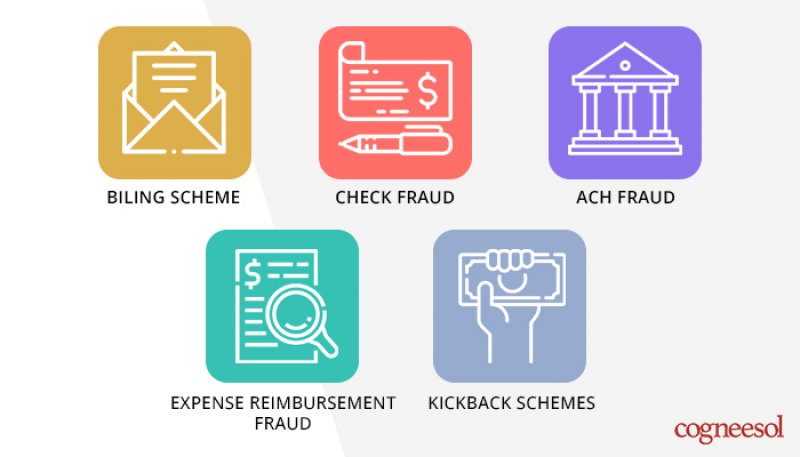

Common Types of AP frauds:

Billing Schemes

Billing schemes are the most common type of method fraudsters or financial scammers use to attack a firm's accounts payable department. While an employee can intentionally perpetrate these, it is not limited to them as other parties can be involved.

For example, an AP employee might create an invoice in the name of a fake corporation and process it using the company accounts for products or services that were never received. Similarly, with the help of an external party, an AP employee might pay for an invoice twice.

Check Fraud

According to the Association for Finance Professionals (AFP) report, 75% of organizations experienced check fraud in 2016. Let's read some of the examples of check fraud. Check fraud might include;

- Adjusting the amount on a check

- Changing the name of the payee

- Writing checks (AP staff member) for personal expenses using the company's checking accounts

ACH Fraud

Automated clearing house fraud (in short – ACH fraud) is fast becoming one of the top AP frauds around the globe. This, in most cases, is committed by in-house AP employees. An AP person can set their name in the company systems as an automatic bill payee (where authentication is not required). Now they get the authority to process invoices that might have been created by them only for fraud purposes. No doubt why many companies outsource invoice processing services to firms that use stringent data confidentiality and security measures.

Fraud related to Expense Reimbursement

Expense reimbursement fraud involves using business-related reimbursable costs and can be committed by any employee. This typical fraud can take two years (averagely) to be detected, according to the ACFE.

Here are some factors that increase the risk of expense reimbursement fraud;

- Incorrect or improper characterization of reimbursable expenses

- Overstating expenses (claiming $50 instead of the actual expense of $40)

- Fake expenses (claiming expenses via fake invoices)

- Repeating claims (claiming an expense reimbursement twice or more)

Kickback Schemes

Kickback schemes are one of those frauds that can damage your business in multiple ways. With the involvement of an insider infringing company norms, this fraud can be dangerous. It happens when an external party offers money to an employee, and in return, they want them to sway certain decisions. For example, your vendor manager can close a deal with a firm that has paid the manager for choosing their firm.

Detecting and Preventing Accounts Payable Fraud

Detecting an AP fraud is challenging and time-consuming, but the bigger problem is that companies don't take adequate measures to prevent one. According to The Association of Certified Fraud Examiners (ACFE), a lack of controls can be attributed to around one-third of frauds. 71% of surveyed organizations cite AP frauds as a huge concern - Beanworks.

As a business owner, if you are looking for ways to enhance your firm's protection against AP frauds, here are a few solutions you can consider.

Track Stolen and Lost Checks

It is always a good habit to keep track of checks by maintaining a list of check numbers. It helps to detect mission checks so that when in need, you would know which ones are stolen or lost, and the best way to identify them is to perform reconciliation of AP records against bank statements. If there's a discrepancy, it must be sent for further investigation.

Closely Check Invoices & Detect Oddities

Have someone from your finance team dedicatedly work on invoice checking and look for the indications of a red flag, such as;

- Invoices are not numbered in a sequence

- Some invoices are skipped

- One number on two or more invoices

Besides, paper invoices that have correction fluid on them, invoices that are photocopied, or those that have traces of being edited, these invoices should be investigated further.

Conduct Audit Regularly and at times, Surprisingly

Regular audits are paramount to check for inaccuracies, and the best thing is that they can also help detect and prevent fraud. While you might already audit accounts regularly, try conducting an unscheduled audit can be of great help. With this, if your employees are plotting a fraud, a surprise audit will ensure they don't get time to sweep it under the rug.

Use AP Tools or Software

Using AP software and integration plugins can help prevent most frauds. These applications allow you to put in fixed payments to be made automatically. Moreover, they have small tools you can use to reconcile statements against transactions and transactions against invoices. However, you may need someone experienced to operate the software effectively.

Conclusion

While tightening control over payments management can be a great way to detect and prevent fraud, outsourcing accounts payable services to a reliable provider can make a huge difference. This is because they are specialists and have years of experience handling invoices and payments for various businesses. They also have strict data protection policies and sign NDA forms before onboarding any accounting project. Now, if we compare the cost of establishing an in-house AP team with the cost of AP outsourcing, you would be surprised to see the difference.

Yes, you can save a lot by outsourcing AP services to companies in other parts of the world. All things considered, it would be fair to say that AP outsourcing can be the best way to prevent payments fraud.

Author Bio:

Stacey Howard has 6 years of experience in accounting & bookkeeping. She has been working as an accountant with reputable firm Cogneesol– accounting and bookkeeping service provider. Due to her passion, she has contributed significantly through her write-ups about multiple accounting industries.

More to Read:

Previous Posts: